- Financial Highlights

- Financial Reports

- Environmental, Social & Governance Reports

- Announcements & Notices

- Returns on Share Capital

- Constitutional Documents

- Circulars

- Press Releases

- Stock Information

- Event Calendar

- Corporate Information

- IR Contact

- Notices (Replacement of Lost Share Certificates)

- Research Report

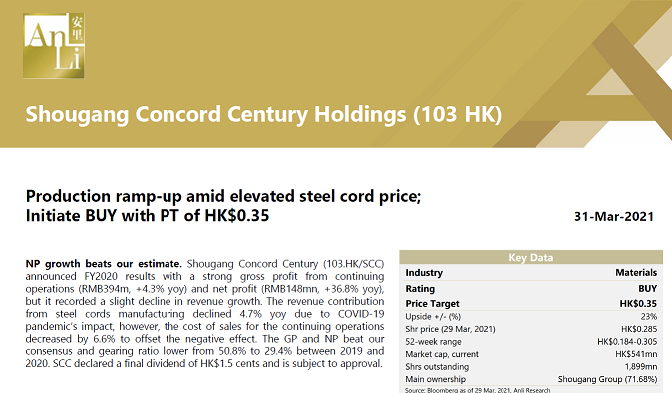

31 March, Anli Research released the research report of Shougang Concord Century (00103.HK), giving the company a “Buy” view of SCCHL with a 12-month target price of HK$0.35.

Shougang Concord Century (103.HK) announced FY2020 results with a strong gross profit from continuing operations (RMB394m, +4.3% yoy) and net profit (RMB148mn, +36.8% yoy), but it recorded a slight decline in revenue growth. The revenue contribution from steel cords manufacturing declined 4.7% yoy due to COVID-19 pandemic’s impact, however, the cost of sales for the continuing operations decreased by 6.6% to offset the negative effect. The GP and NP beat our consensus and gearing ratio lower from 50.8% to 29.4% between 2019 and 2020. SCCHL declared a final dividend of HK$1.5 cents and is subject to approval.

SCCHL’s total sales volume increased 1% from 203,318 tonnes to 205,367 tonnes from 2019 to 2020. The sale volume of steel cords for tyres increased 2.7% yoy from 130,080 tonnes to 133,534 tonnes during the same period, thanks to strong demand for vehicle manufacturing in the EV sector. The highlight of the result was the rapid growth of sales in sawing wire products, which saw a +161.9% growth in sales volume, due to increasing order of new clients post COVID-19 impact with low base effect. As the pandemic’s impact dwindles, management guided that steel cords sales volume growth could increase significantly as the recovery rate of social and economic activities resume quickly in 2021. As such, we expect a 25% yoy sales volume growth of steel cords in 1Q21.

We forecast the revenue estimates for SCCHL to grow 20.6% in 2021E and 13% in 2022E to reflect our positive view of the company’s recent positive results. We expect the monetary policy strategy would support the credit flowing to the commodity sector, and positive automotive manufacturing would continue to favor steel cord price and demand, in terms of more sequential margin improvement of SCCHL. In our view, for SCCHL, with the stock trading at 0.27x 2022E P/B, versus the historical (5-year) range of 0.33x, risk-reward is attractive. Given the company’s prevailing market shares in China steel cord markets, potential re-rating on structural growth path supports our “Buy” view of SCCHL with a 12-month target price of HK$0.35.